Barcelona Tourist Tax Rates. What travelers need to know before their stay

Barcelona applies a tourist tax to overnight stays in tourist accommodation, including licensed holiday apartments.

As local hosts, we receive many questions about this tax, so below you’ll find a clear and straightforward explanation of how it works and what to expect during your stay.

What is the Tourist Tax?

The Barcelona tourist tax, officially known as the Impost sobre les Estades en Establiments Turístics (IEET), is a mandatory tax applied to guests staying in tourist accommodation such as hotels and licensed holiday apartments.

Its purpose is to help fund tourism-related projects, maintain public spaces, and preserve cultural and cultural heritage.

How much is the tourist tax and who has to pay it?

For licensed tourist apartments located in the city of Barcelona, the current tourist tax is €6.25 per person, per night, with a maximum of 7 nights per person for the same accommodation and continuous stay.

This tax applies to all guests aged 16 and over, regardless of nationality or place of residence, including residents of Barcelona staying in tourist accommodation.

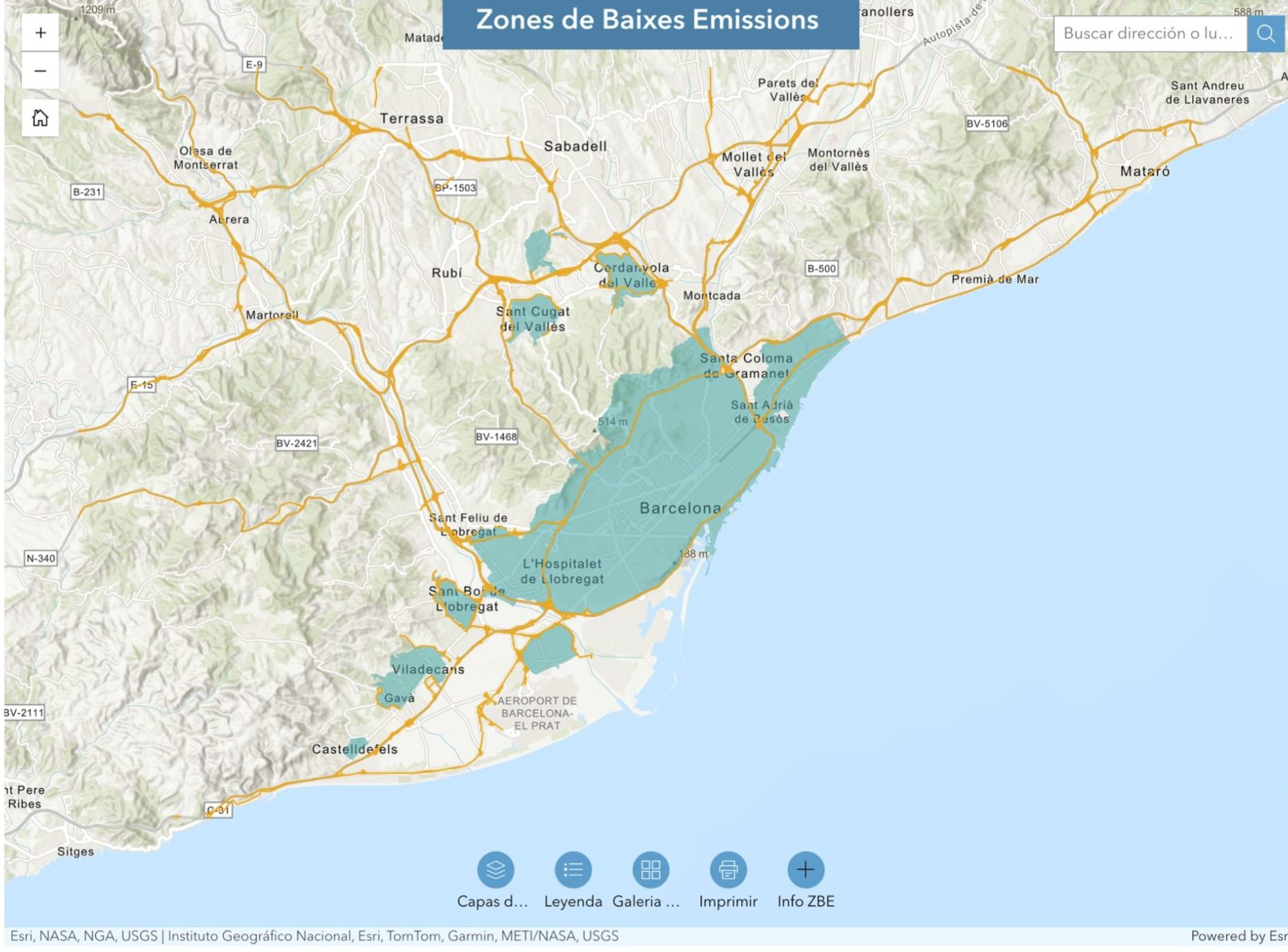

In Barcelona, the tourist tax is made up of a regional tax and a municipal surcharge. Rates may vary depending on the type of accommodation and whether the stay is within the city of Barcelona or elsewhere in Catalonia.

How and when is the tourist tax paid?

The tourist tax is paid directly to the property owner or property manager, usually at check-in or before arrival, depending on the booking process.

Hosts are legally required to collect this tax on behalf of the authorities and transfer it to the Generalitat de Catalunya. For this reason, the tourist tax is often not included in the accommodation price and may be charged separately.

Why is the tourist tax charged separately?

In many cases, especially in tourist apartments, the tourist tax is charged separately from the accommodation price.

This is because the tourist tax is a mandatory local tax that hosts collect on behalf of the authorities. Charging it separately allows it to be clearly identified, declared, and transferred in accordance with local regulations..

More info:

For official and updated information, you can consult the Catalan Tax Agency website in the following link: https://atc.gencat.cat/es/tributs/ieet/quota-tributaria/.Or download the official rate documents below.